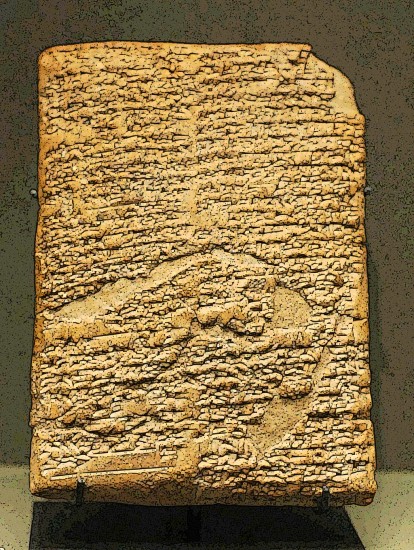

The image (derived from Wikipedia Commons) is of a clay tablet that contains the prologue to Hammurabi’s Code.

The latest regulatory atrocity that made me go here is the Obama administration’s plan (now dropped, at least in this instance) to regulate pharmaceutical companies by forcing the resignation of executives it disapproves of. (WSJ article: “U.S. Drops Effort to Oust Forest Labs CEO” The print edition headline was a less honest, less accurate one: “Forest Chief Prevails Over U.S.”)

When I was a wee kid in elementary school (possibly as early as 4th grade) we learned that Hammurabi’s Code was an advance because people knew from it what the laws were and what the penalties were. Now our leaders devise regulatory systems under which nobody can know what is required, and under which the best one can do is try to stay on the right political side of the authorities. And this in an environment where the current administration has been willing to attack and threaten private businesses that make political statements that it perceives to be critical or contrary to its agenda.

People in our country used to understand about due process. But now we have President who supposedly has an advanced degree in constitutional law, but who institutes a regulatory system that is about as far from any constitutional system as you can get. And some headline writers for the WSJ don’t get it.

There is such a thing as good regulation and there is necessary regulation. I’ve long wished that we could discuss good vs bad regulation rather than re-regulation vs deregulation. But trying to regulate in the way Obama has tried to do here is likely to give all of regulation a bad name.

So to do my part to get the discussion back where it needs to be, I’ve instituted a new category of articles: Hammurabi-Handedness. That term is in part an allusion to related concepts, such as the invisible hand. Hammurabi-Handedness refers to letting the invisible hand do its thing, but within a regulatory system that is as clear and well-defined as possible, and which minimizes waste and corruption.